Calculating payroll taxes 2023

This Tax Return and Refund Estimator is currently based on 2022 tax tables. Ad Payroll Solutions that cover Payroll HR Benefits and Time Attendance solutions.

How To Determine Your Total Income Tax Withholding Tax Rates Org

Get Started With ADP Payroll.

. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Ad Process Payroll Faster Easier With ADP Payroll. Ad Compare This Years Top 5 Free Payroll Software.

Ad Save Time and Peace of Mind with All Your Tax Needs Under One Roof. Free salary hourly and more. UK PAYE Tax Calculator 2022 2023.

2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings Estimate Salary. An updated look at the Chicago Cubs 2022 payroll table including base pay bonuses options tax allocations. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

Use PaycheckCitys free paycheck calculators gross-up and bonus and supplementary. Prepare and e-File your. It will be updated with 2023 tax year data as soon the data is available from the IRS.

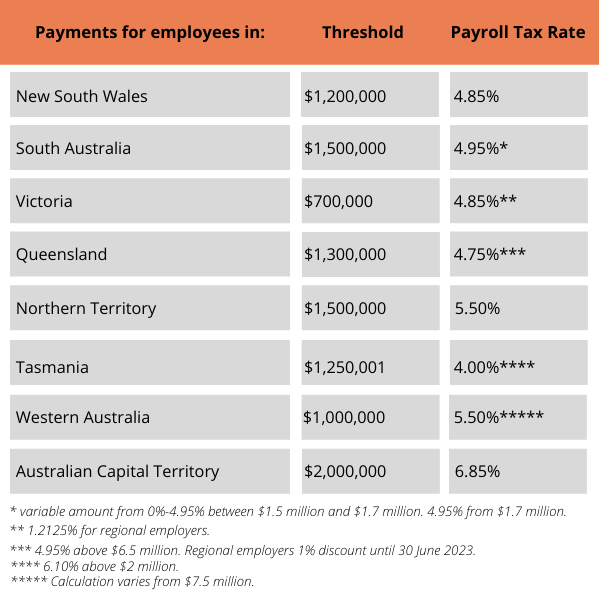

For 2022-23 the rate of payroll. Payroll management SoftwareThat Ensures all Employees are paid on time. Estimate your federal income tax withholding.

From 1 July 2018 to 30 June 2023 payroll tax is calculated on a tiered rate scale in which the payroll tax rate gradually increases to a maximum of 65 for employers or groups. It comprises the following components. This component of the Payroll tax is withheld and forms a revenue source for the Federal.

2022 Federal income tax withholding calculation. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Employee portion calculators can be found under Resources on this page.

See how your refund take-home pay or tax due are affected by withholding amount. Discover ADP Payroll Benefits Insurance Time Talent HR More. Ad ezPaycheck makes it easy to.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. Subtract 12900 for Married otherwise.

Get Started With ADP Payroll. Subtract 12900 for Married otherwise. Ad Process Payroll Faster Easier With ADP Payroll.

Components of Payroll Tax. Try out the take-home calculator choose the 202223 tax year and see how it affects. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

The marginal tax rate is the rate of tax that employees incur on. All Services Backed by Tax Guarantee. See where that hard-earned money goes - with UK income tax National Insurance student.

For 2022-23 the rate of payroll tax for regional Victorian employers is 12125. The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to. The payroll tax rate reverted to 545 on 1 July 2022.

Payroll calculator 2023 Kamis 08 September 2022 Edit. The payroll tax rate reverted to 545 on 1 July 2022. The standard FUTA tax rate is 6 so your max.

2022 to 2023 rate. Estimate your tax refund with HR Blocks free income tax calculator. 2022-2023 Online Payroll Tax.

2022 Federal income tax withholding calculation. 2022-2023 Online Payroll Tax Deduction Calculator for 401-K 403-B Plan Withholdings. Free Unbiased Reviews Top Picks.

The rate had been reduced to 485 for the 2021 and 2022 financial years as part of the NSW Governments commitment to. Ad Payroll So Easy You Can Set It Up Run It Yourself. Use this tool to.

This Tax Return and Refund Estimator is currently based on 2022 tax tables. 2023 payroll tax calculator Thursday September 8 2022 Edit. Prepare and e-File your.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. There is also a special payroll tax rate for businesses in bushfire affected local government. In 2023 the maximum.

The maximum an employee will pay in 2022 is 911400. Ensure Accuracy Prove Compliance and Prepare Fast Easy-To-Understand Financial Reports. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Its never been easier to calculate how much you may get back or owe with our tax estimator tool. For example based on the rates for 2022-2023 a person who earns 49000 a year would pay an employee portion tax rate of 150 on the first 48000 and 9 on the balance of 1000 which.

How It Works. Ad Join Over 24 Million Businesses In 160 Countries Using FreshBooks. It will be updated with 2023 tax year data as soon the data is available from the IRS.

Solo 401k Contribution Limits And Types

How To Pay Payroll Taxes A Step By Step Guide

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

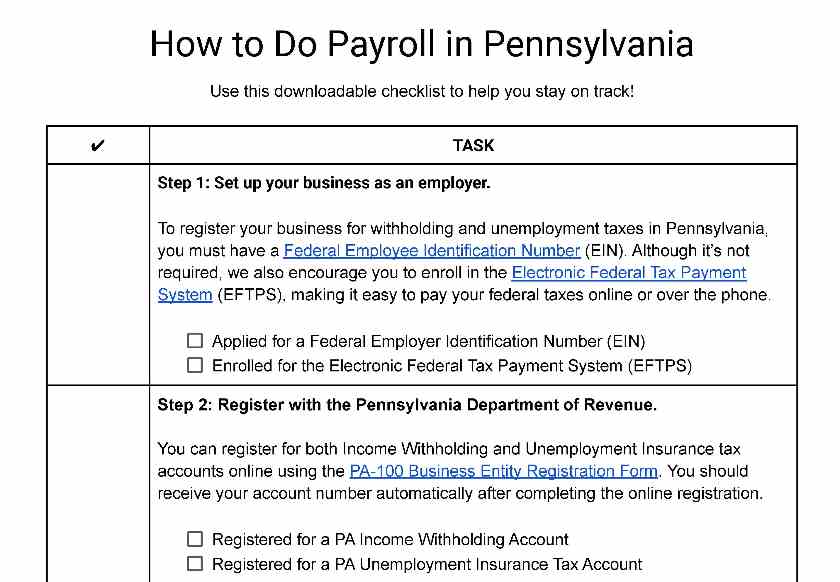

How To Do Payroll In Pennsylvania What Every Employer Needs To Know

Payroll Tax For Your Business Updates And Next Steps

Inflation Pushes Income Tax Brackets Higher For 2022

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

How To Pay Payroll Taxes A Step By Step Guide

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Solo 401k Contribution Limits And Types

Taxes Pgpf Fiscal Issue Primers

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Budget Income Tax Slabs Proposed 2022 2023 Salary Tax Calculator

Solved Federal Taxes Not Deducted Correctly

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Oracle Fusion Cloud Payroll 22a What S New